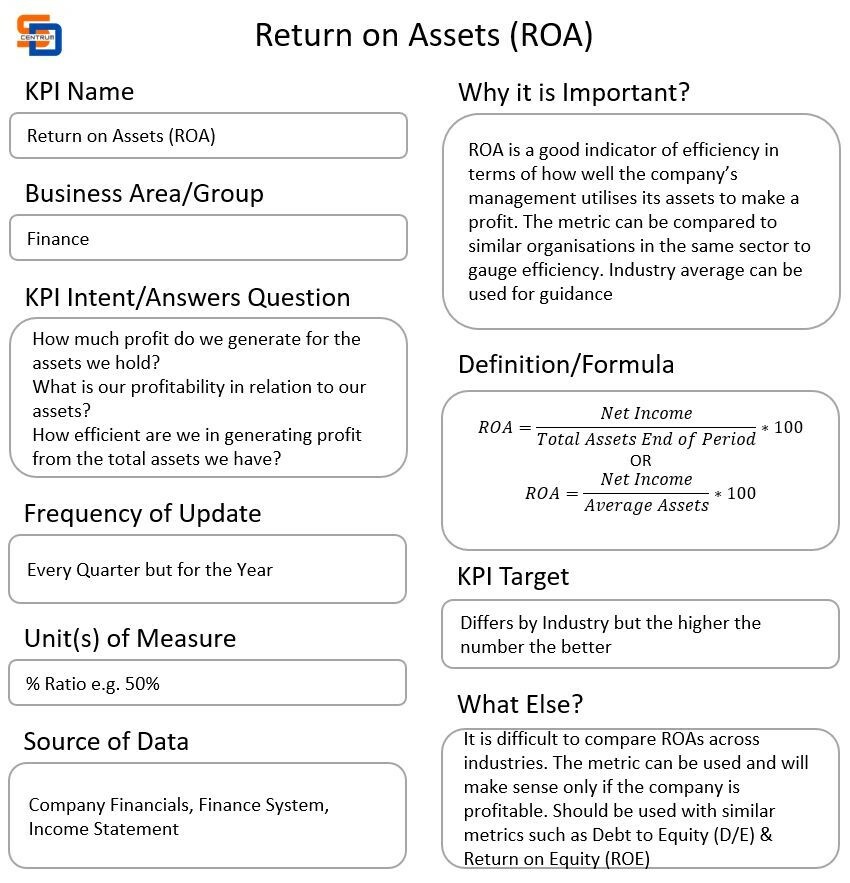

Return on Assets (ROA) is a great measure of a company’s efficiency and shows how well its assets are being utilised.

Why is it important?

ROA is a good indicator of efficiency in terms of how well the company’s management utilises its assets to make a profit. The metric can be compared to similar organisations in the same sector to gauge efficiency. The industry average can be used for guidance.

What questions does KPI answer?

1) How much profit do we generate for the assets we hold?

2) What is our profitability in relation to our assets?

3) How efficient are we in generating profit from the total assets we have?

KPI target

Differs by industry but the higher the number the better.

It’s difficult to compare ROAs across industries. The metric can be used and will make sense only if the company is profitable. Should be used with similar metrics such as Debt to Equity (D/E) & Return on Equity (ROE).

Data sources

Company Financials, Finance Systems, Income Statement.

KPI Formula

ROA = (Net Income / Total Assets End of Period) * 100, or

ROA = (Net Income / Average Assets) * 100

Below is a detailed KPI map: