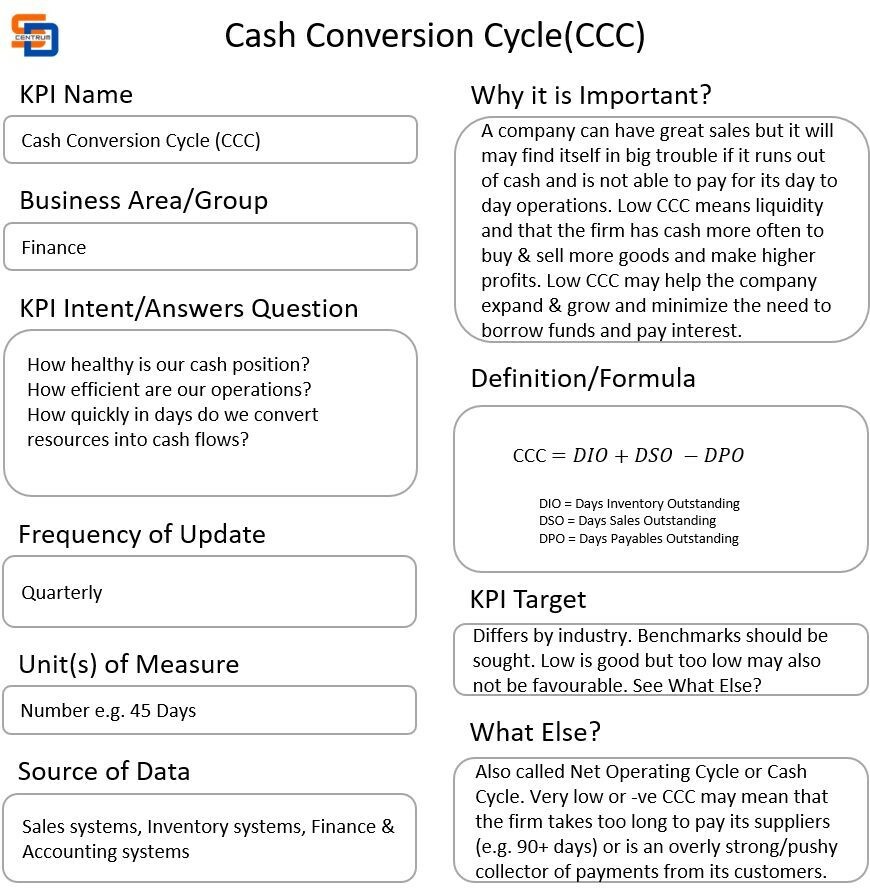

Cash Conversion Cycle (CCC) is a great measure of efficiency and performance as it actually measures and produces 4 KPIs.

According to an old Forbes article, Amazon used to have a negative CCC but is that always such a good thing?

Why is it important?

A company can have great sales but it will find itself in big trouble if it runs out of cash and is not able to pay for its day-to-day operations. Low CCC means liquidity and that the firm has cash more often to buy and sell more goods and make higher profits. Low Cash Conversion Cycle KPI may help the company expand and grow and minimize the need to borrow funds and pay interest.

What questions does KPI answer?

1) How healthy is our cash position?

2) How efficient are our operations?

3) How quickly in days do we convert resources into cash flows?

KPI target

The target differs by industry, but a benchmark should be sought. Low CCC is good but too low may also not be favourable.

Also called the Net Operating Cycle or Cash Cycle. Very low CCC may mean that the firm takes too long to pay its suppliers or is an overly strong/pushy collector of payments from its customers.

Data sources

Sales systems, Inventory systems, Finance & Accounting Systems.

KPI Formula

CCC = DIO + DSO – DPO

Where DIO is Days Inventory Outstanding, DSO is Days Sales Outstanding, and DPO is Days Payable Outstanding.

Below is a detailed KPI map: